Is the UBO Register useful during KYC processes?

It was a tedious job to complete the UBO Register for companies. There were a number of start-up problems that made it difficult to transmit all the data on time.We were finally able to do so, but the deadline was extended to September 30, 2019 and tolerated until December 31, 2019, without fines to meet the obligations.

Go directly to the page Log into the register.

Although a practical question remains for compliance professionals: is the UBO Register useful during KYC processes? And how can financial institutions use the UBO register of beneficial owners as a controlling tool in Customer Due Diligence ("CDD") processes?

How to use UBO Register in your client identification and verification process ?

Specifically, an UBO declaration will then be requested by the client, or its financial director, or a director with these reduced thresholds. An audit in the balance sheet of the state of the company's capital and the shareholder structure can provide clarity.

The approach should be clearly included in the CDD procedures with clear examples for the KYC analysts.

Obligation to verify the information in the UBO Register

On the basis of Article 19 § 1 of the above-mentioned Royal Decree, any entity concerned must notify the Treasury electronically of the difference between the information contained in the register and that of which it is aware. This obligation to provide information applies to the competent authorities insofar as it does not prevent them from fulfilling their legal obligations.

They verify the identity of the people behind the companies with whom they do business in their CDD processes.

Which ways can UBO verification be used?

As with other business processes, an internal procedure must be established in which not only access is regulated, but also a cross-reference to CDD processes in which the escalation procedure is described. A systematic approach and a variety of reliable sources can be used:-

The (audited) annual accounts filed with the Central Balance Sheet Office of the National Bank of Belgium;

-

The Crossroads Bank of Enterprises ;

Annual accounts on the website of the company and companies of the group (shareholdings and cross shareholdings) ;

Financial information about the company

Statements on shareholdings (since the Law of 2 March 1989) in listed companies ;

The appendices and publications in the Belgian Official Gazette relating to companies ;

Similar trade registers, balance sheet centres abroad

Press releases, etc.

Why is it important to identify a Beneficial Owner ?

For example, money laundering can involve complex operations and transactions to make money from illicit sources, such as drug trafficking or tax evasion, appear legal.

A drug trafficker, for instance, could set up a night club in order to appear to have legal sources of income from the sale of tickets and alcohol, while in reality the money is coming from the sale of drugs.

In a business setting, it is therefore important to know the Beneficial Owners of legal entities to prevent misuse. That is why the FATF, and later the Global Forum, have included beneficial ownership requirements in their standards and conduct assessments across jurisdictions on the availability of beneficial ownership information in their systems.

In July 2020 there has been a recent update to the UBO Register legislation in Belgium. The Belgian parliament approved a law that transposes the EU’s Fifth Anti-Money Laundering Directive (5AMLD) into national law, which includes changes to the UBO Register requirements. Under the new law, companies are required to submit additional information about their UBO’s, including their national identification number and information about the nature and extent of their economic interests in the company. Additionally, the law increases the penalties for non-compliance with the UBO Register requirements.

Examples of legal vehicles that mask a Beneficial Owner

Bearer shares and bearer share warrants are a common way to hinder identification of a company’s beneficial owner. Bearer shares allow the transfer of ownership by simply handing the shares to another person. Some countries prohibit bearer shares and warrants and others require that they be immobilised in a custodial arrangement, but a few countries still allow them to be used freely and these countries should take measures to address the risks from bearer shares immediately.Another factor that makes it difficult to identify a Beneficial Owner (BO) is nominees. The use of nominees, whereby an entity allows its name to appear as a shareholder or owner in the name of someone else (whose identity remains concealed), is prohibited in some countries but legal in others. In some cases, nominee shareholders mask the real BO.

Investigators therefore must obtain information from each country to find out who controls each layer. If one country in the chain does not exchange information with others, or if it does not even have the information, it is more challenging to identify the ultimate beneficial owner.

If all countries held information about Beneficial Owners in every case, the strategy of hiding behind a chain of legal vehicles would be less effective where an exchange of information relationship exists.

Feel free to read the OECD report on "Beneficial Ownership Implementation Toolkit" for more practical information !

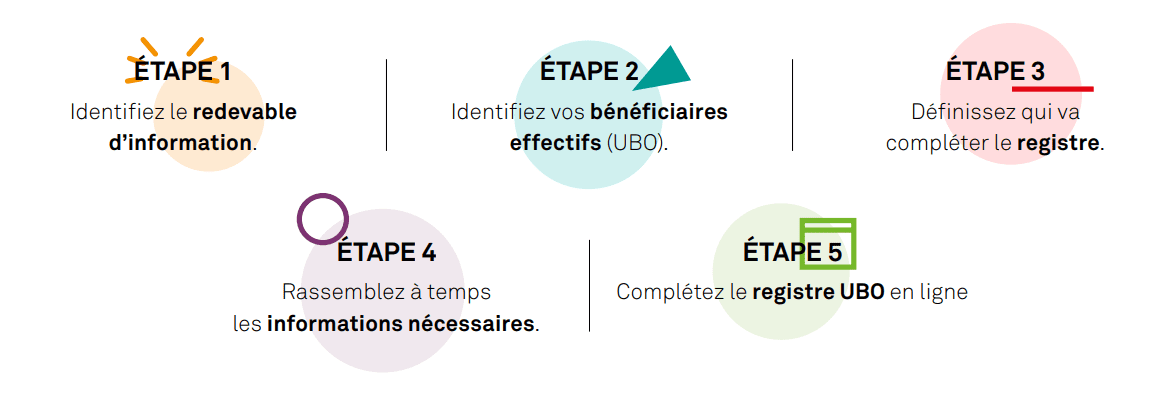

How to encode information in the UBO Register?