Market Abuse

Market abuse destroys the integrity of the market and leads to financial instability. Investors must be protected from any manipulation and must feel confident to invest in the markets.

In the EU, the Market Abuse European Regulation 596/2014 and the Directive 2014/57/EU on the criminal penalties applicable to market abuse focuses on harmonizing the rules and following the developments in the financial markets following the 2008 crisis. The Regulation clearly states that professionals and investment firms must have efficient "arrangements, systems and procedures aimed at preventing and detecting insider dealing...".

What is market abuse?

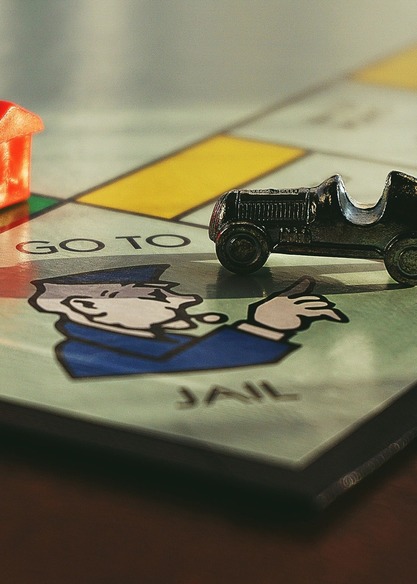

Market manipulation is prohibited and has strong repercussions, including fines, jail time, and harm to the reputation of those engaged, whether they be people or businesses. The surveillance of trading activity, the investigation of suspicious behavior, and the imposition of sanctions on individuals found guilty of engaging in such practices are just a few of the steps regulators throughout the world have put in place to prevent and identify market abuse.

What is insider dealing?

How can Pideeco help you with Market Abuse?

Our decade-long experience in financial markets can help your business to:- Draft or improve your procedures on market abuse.

- Help you navigate the regulatory framework for market abuse.

- Combine legal, financial, and IT knowledge to establish and maintain systems to detect market abuse that are tailor-made for your business.

- Create a gap analysis of your company’s market abuse systems and help you to make them more efficient.

- Conduct ex-post transaction investigations and report accordingly to the management.

- Write requirements for sample selections for monitoring and testing purposes for the 2nd line of defence.

- Train your staff members on any topic concerning market abuse.

Let us know how we can help! We'll get back to you lightning quick!

You'd rather talk face to face? Complete the form and schedule a meeting

Europol defines Financial Crime as "illegal acts committed by an individual or a group of individuals to obtain a financial or professional advant...

Return to financial crime

An audit trail (also called audit log) is a relevant chronological recording of actions, a set of files, or the destination of a collection of records that represent a sequence of successive activities or events within an operational environment, a procedure or any othe...

Read more Author What else ?

-806688168.jpg)