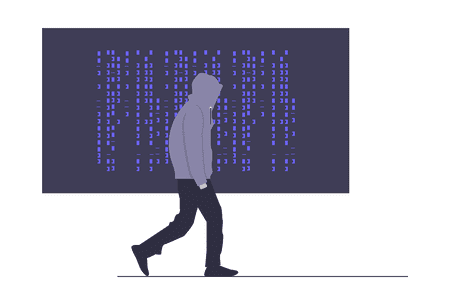

Cybersecurity

To protect themselves, companies must adapt their cybersecurity program by anticipating risks to, detecting incidents, and responding effectively.

What is cybersecurity?

Prioritizing cybersecurity is crucial for individuals, businesses, and governments to protect their electronic devices and data as well as to avoid potentially disastrous outcomes like monetary loss, reputational harm, and weakened national security. Gartner, a technological research and consulting firm, predicts that by 2025 supply chain attacks will have an effect on 45% of global enterprises.

How can Pideeco help you with Cybersecurity?

If you run a professional business, have a website, and store online, in a system, or in a cloud information on services, products, and clients, you are vulnerable to cyberattacks. Our IT experts at Pideeco can help you to:- Understand if you have had a security breach in your website or systems.

- Analyze your security parameters and create a gap assessment.

- Anticipate any potential cybersecurity threats that your business or IT systems may be exposed to.

- Help you block any incidents and repair the damage as rapidly as possible.

- Aid you with incident reporting.

- Improve your detection and response capabilities.

- Advise and implement cybersecurity systems.

- Assist you with the regulatory reporting on cyber security measures.

Let us know how we can help! We'll get back to you lightning quick!

You'd rather talk face to face? Complete the form and schedule a meeting

Europol defines Financial Crime as "illegal acts committed by an individual or a group of individuals to obtain a financial or professional advant...

Return to financial crime

The digital era has given KYC analysts unprecedented access to a plethora of information on individuals and companies. Newspaper articles, online blogs, and social media are accessible and filterable with one click and may reveal important news on a financial institutio...

Read more Author What else ?