Monitoring and Reporting

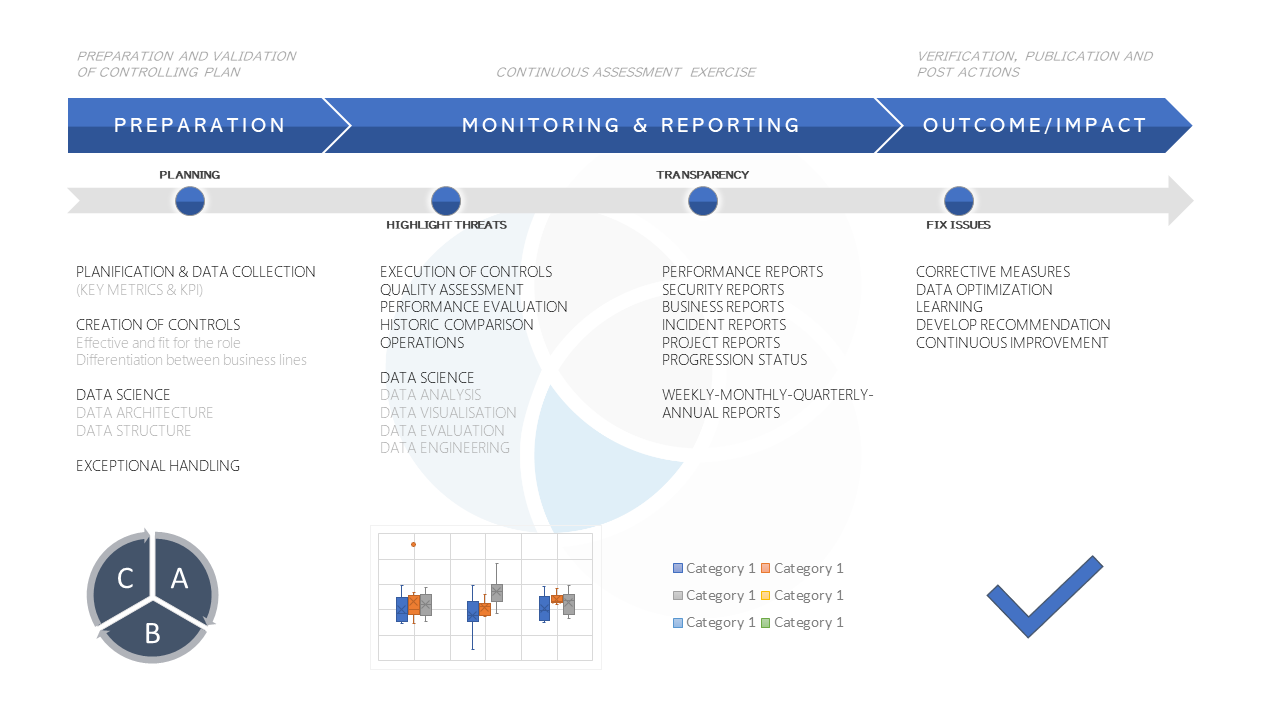

In the context of financial institutions, appropriate measures must be taken to monitor financial relationships and transactions involving a high risk of money laundering or terrorist financing. Monitoring can be performed through manual or automated processes, or a combination of both, depending on the size of the business and risks involved.

How can financial institutions monitor suspicious behavior?

Companies can efficiently monitor data by building on available resources and business processes, developing policies and procedures, and use critical analytics on past performance to design enhanced workflow mechanisms. Historic qualitative data might be the key to identifying figures that will help get a sense of what is at stake and properly evaluate previous methods.For larger firms, it may be necessary to delegate the development of a monitoring system to an experienced technical team.

How can Pideeco help you with Monitoring and Reporting?

Monitoring and reporting can at times be burdensome for financial institutions, especially if the staff is not well trained, the quality of the data is low, and the monitoring systems are not tweaked to give the best results. Pideeco’s decade-long experience in compliance and the financial sector can help your company to:- Evaluate your current monitoring processes and systems to create a gap analysis and a mitigating action plan.

- Set-up an efficient monitoring system tailored to your company’s size and needs.

- Draft or improve your monitoring policies and procedures.

- Tweak and improve your current monitoring systems to produce more efficient and precise results.

- Train your staff on how to operate the monitoring systems .

- Train your staff on reporting requirements.

- Execute the monitoring procedures and systems on your behalf.

- Execute reporting requirements on your behalf.

- Execute and report lookback exercises if required.

Let us know how we can help! We'll get back to you lightning quick!

You'd rather talk face to face? Complete the form and schedule a meeting

Central Compliance is the organization of all the compliance monitoring and controlling the professional activities of a given business or company thr...

Return to central compliance

A top-down approach highlights the behaviour of regulatory changes in the financial institution and helps the Compliance Officer to build a strong Governance. This principle is also known as “tone at the top” in ethical and responsible business behaviour. From the h...

Read more Author What else ?

-806688168.jpg)