The past financial data leaks unveiled by the ICIJ have disclosed close to one million shell companies used for illicit or murky purposes, but the ease and low cost of establishing such entities, coupled with the opacity that such corporate vehicles give to their beneficial owners, makes the problem ongoing and extensive.

The problem has been known for decades. In 2005, FinCEN’s “U.S. Money Laundering Threat Assessment” noted that shell companies are prone to money laundering and other financial crimes as they are “easy and inexpensive to form and operate.” In 2006, the FATF report “The Misuse of Corporate Vehicles, Including Trust and Company Service Providers” painted a similar picture.

Despite years of warnings, cases, and regulations, shell companies continue to be a recurrent headache in the fight against financial crime.

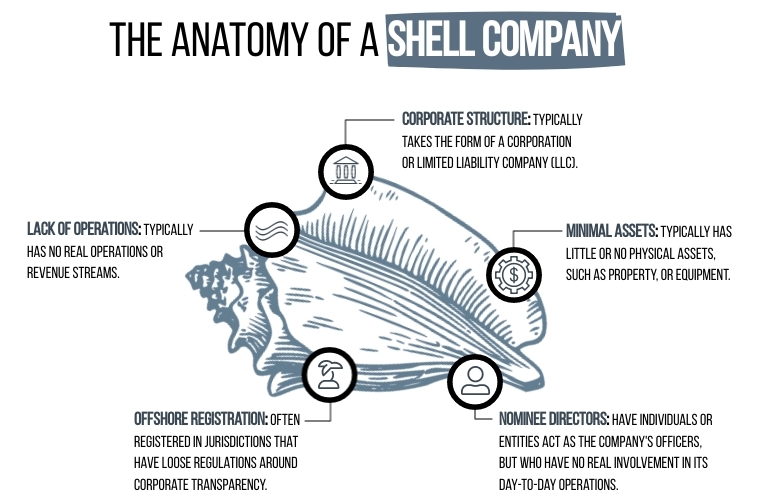

What is a shell company?

A shell company can be defined an entity that only exists on paper and lacks any active operations, resources, or personnel of its own. They have no physical office, with addresses usually linked to a mailbox, and are favored in countries with lax regulatory oversight or in tax havens.

Setting up a shell company is relatively easy, requires only a few hours, and can cost between $100 to a few thousand dollars depending on the country where it is established and on the service used. The founder can appoint a strawman as the director of the company. Lawyers, notaries, and Corporate Service Providers (CSPs) are used to set-up such companies. They can also serve as directors for the entity, if needed.

There are different types of shell companies. These include, but are not limited to:

-

Anonymous shell companies: the ultimate beneficial owner is concealed behind the corporation or a network of connected shell companies in other jurisdictions, providing anonymity and control over the company's resources. They are frequently connected to illegal activities.

Shelf companies: a type of company that has previously been incorporated but has never done business. It is kept until sold to a buyer who can use it to launch a new firm using an already-known company name, avoiding the process of starting a new corporation from scratch.

Special Purpose Entities (SPE): this type of company primarily engages in group financing or holding activities, with few employees and little physical presence in the host economy. Its assets and liabilities include investments made abroad and are frequently used for aggressive tax planning.

Letterbox companies: this type of corporation is registered in one state but operates in another. They can be used to get around labor rules of the nation where the activity is taking place.

Navigating the Regulatory Maze: Where Compliance Meets Simplicity.

Embark on a journey beyond convoluted information, where compliance transforms into a strategic advantage. Click register to access our premium articles and stay steps ahead in the game. 🚀

The remainder of this article is exclusively available to our registered users!

Sign up for free to access:

- 🚀 Premium articles: Get in-depth insights and expert analyses on trending topics.

- 💡 First-rate content: Navigate complex frameworks with clarity using tips and regulatory guidelines.

- 🌟 Expert insights: Unlock a trove of expert insights, keeping you steps ahead of ever-changing regulations.

Don’t stay in the dark—embrace clarity and confidence on your compliance journey ☀️ Subscribe now and get immediate access to all our premium content for free! 🎁