ESG-related assets under management, whose purpose are to provide financial gains while simultaneously encouraging social and environmental advantages – like lowering carbon emissions, fostering racial and gender diversity, and enhancing working conditions – are expected to grow 84% in the coming years, increasing from $18.4 trillion in 2021 to $33.9 trillion by 2026.

Recent controversies involving ESG-related assets and greenwashing have shown that there is an increasing need for industry standards and regulatory frameworks to guarantee that ESG claims made by corporations and funds are true and verifiable.

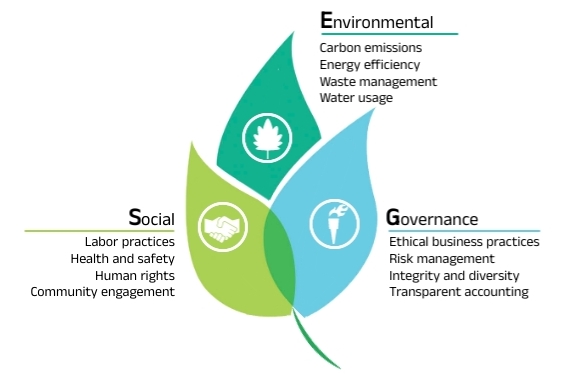

What is ESG?

ESG, or environmental, social, and corporate governance, can be defined as a set of standards that investors use to assess the morality and sustainability of a company's management and activities.The practice first emerged in the 1950’s when trade unions began investing capital in health facilities and affordable housing projects, and continued evolving in the 60’s with the Vietnam War and the protest movements. It wasn’t until 2004 that the term ESG became popular with the United Nations report “Who Cares Wins,” which outlines recommendations by the financial industry to better integrate ESG issues in asset management and securities brokerage.

Nowadays, ESG has become an integral part of most companies’ corporate social responsibility and long-term business strategy. A study by the Harvard Law School Forum on Corporate Governance found that in 2022, Europe had the highest percentage of ESG users – 93%, compared to 79% in North America and 88% in Asia-Pacific.

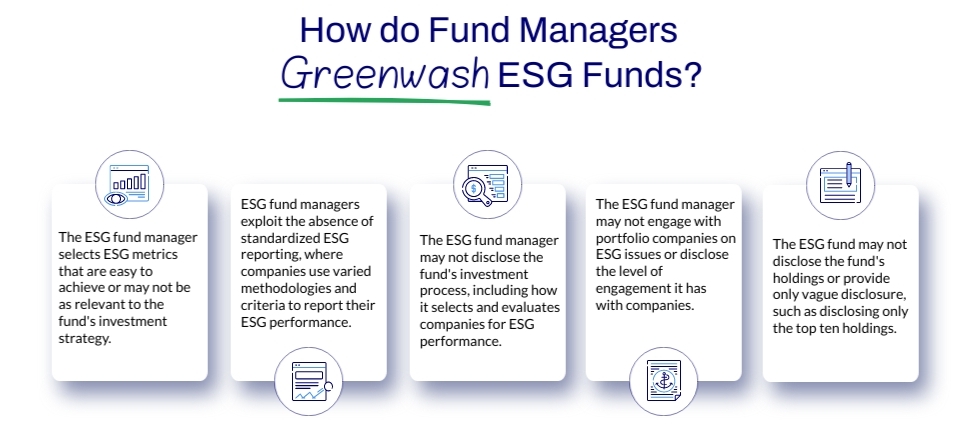

How are ESG assets used for greenwashing?

In a 2022 poll by Politico, respondents of 13 countries agreed that companies should be responsible for paying the growing cost of climate change. The public’s interest in eco-friendly entities and ESG investments has prompted various dishonest businesses to capitalize on the trend by attaching the ESG label to non-sustainable products as a marketing ploy or to charge higher prices.

A major issue when it comes to ESG labelling is in the calculation of ratings. ESG ratings analyze a company's effects on society, the environment, and governance to give stakeholders a complete picture of how well it is performing. However, the transparency of the scores were questioned by the OECD and other regulatory bodies. A company may excel in one aspect of ESG but underperform in another, yet their rating could still be considered high just because of their performance in that one category.

What are examples of ESG and greenwashing?

Below are some examples of companies that have used ESG for greenwashing:-

Fashion brand H&M was sued by a New York federal court for falsely claiming that its Conscious Collection was sustainable when in fact they were using more water to manufacture the items than their regular clothes.

In 2022, sporting good retail chain Decathlon came under fire when the Netherlands Authority for Consumers and Markets (ACM) reported that the company made “unclear and insufficiently substantiated sustainability claims.” This led to the chain paying a donation of €400.000 to sustainable causes.

In 2021, the U.S. Securities and Exchange Commission (SEC) opened an investigation against Deutsche Bank for overstating its ESG credentials for its $1 trillion fund range. A German consumer group sued the company in 2022 for “misrepresenting a fund's green credentials in marketing materials.”

FIFA faced various complaints at a Belgian advertising ethics panel for its deceptive “carbon neutral” claims for the 2022 World Cup in Qatar.

Other companies that have been accused of greenwashing include Shell PLC, Goldman Sachs, Coca Cola, Exxon Mobil, Nestle, and many others.

How are authorities cracking down on the greenwashing of ESG assets?

As the demand for environmentally and socially responsible investments increases, authorities are taking action to prevent the mislead of investors through greenwashing of ESG assets.In 2022, the U.S. Securities and Exchange Commission (SEC) proposed two rules to enhance the consistency and comparability of ESG investments. The first, Fund Names Rule Amendment, does not allow funds to use terms such as “sustainable” and “green” if ESG aspects are “generally no more significant than other factors in the investment selection process.” The second, the ESG Disclosure Rule, would mandate that investment managers publish thorough information about the methods, standards, and information they employ to meet investment objectives, enabling investors to verify fund claims.

As part of its Renewed Strategy of 2021, the EU had also stated that it expected supervisors to be crucial in identifying, preventing, investigating, penalizing, and correcting greenwashing.

The effects of these new and proposed regulations are already being felt. Jefferies Group, an American multinational independent investment bank and financial services company, found that reclassifications of funds that add an ESG element were down 84% compared to 2021 with Europe leading, while new ESG funds fell 60%.

What improvements are needed in the fight against greenwashing?

Greenwashing remains a persistent issue for investors looking for assets with a genuine commitment to the environment and society. While recent regulations and guidelines have shown promise in tackling the problem, there are further steps that need to be taken to truly eliminate the harmful practice.

A clear-cut description of what a sustainable investment entails would give asset managers the correct framework to make investment decisions and provide investors with the necessary information to understand the ESG implications of their investments.

While regulations can be a powerful tool, they must also be designed in a way that encourages transparency and does not stifle innovation or investment in sustainable solutions. Striking the right balance between regulation and innovation will be an ongoing challenge in the fight against greenwashing, but it is essential for building a more sustainable and responsible financial system.

The ESG asset market has made progress in recent years to combat greenwashing but there is still much work to be done. Investors and asset managers must be cautious in the fight against greenwashing and endeavour to establish a more open, accountable, and sustainable financial system as the demand for ESG investments rises.