Compliance Consultancy

Risk management and Consultancy firm

Contact us

info@pideeco.be

Compliance Consultancy

Risk management and Consultancy firm

The rise of Digital Business Compliance Approach

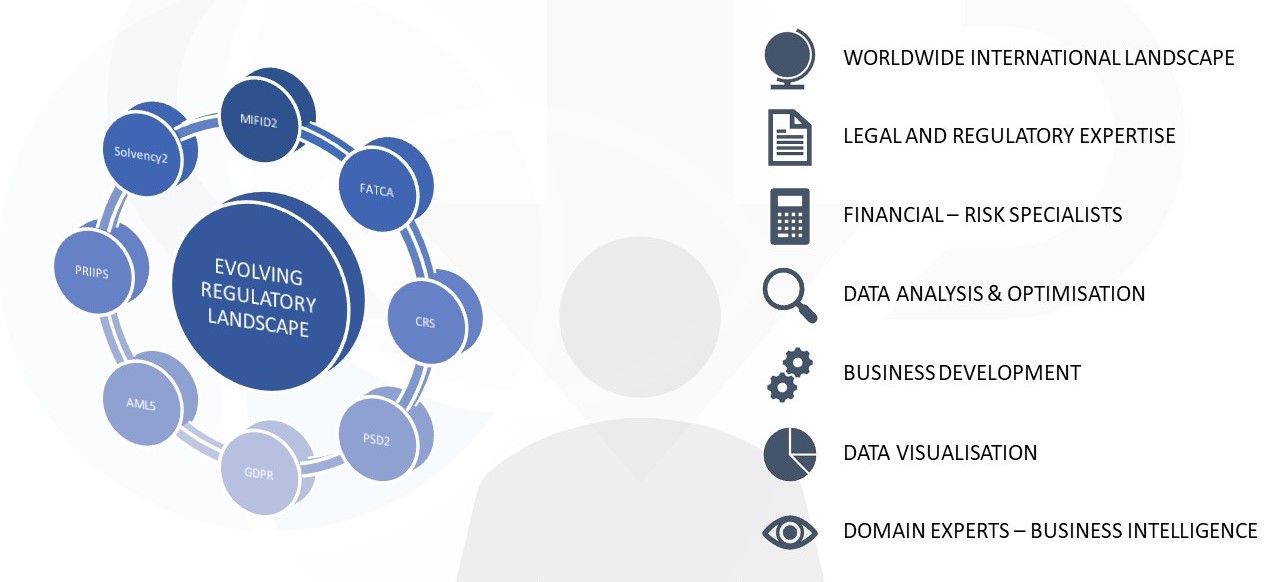

The essence of Compliance changed in the past years as an answer to the changing financial and socio-economic environment.Within Compliance we can distinguish two major blocks. The first block is everything related to Financial Crimes Compliance and the second block is the Central Compliance.

The organisation of all the compliance monitoring and controlling activities

Learn moreFinancial regulatory compliance modern challenges

The changing regulation, reporting (not solely FATCA and CRS), financial crisis (MiFID2, PRIIPs,...), shareholder return, source of wealth and source of funds (vast majority of UHNWI will no longer be based on continental Europe but in other parts of the world like the United States, China, Brazil, Russia, India, Australia,...) require a different approach within the financial business environment.

The capabilities of a consultant in Compliance requires a multiskilled person that can cope with numerous publications. The high degree of harmonisation across the EU through the single rulebook after the financial crisis allows us to partner with our colleague consultants around Europe.

Legal harmonisation stimulates the compliance global approach

We are also able to speak with peers within the world of Insurance as the harmonization through Solvency II applies.The deployment or the positive equivalence determination of Solvency II in Bermuda had already an impact in Belgium and continental Europe.

So on the one hand we might think that overregulation would slow down the business, but on the other hand we observe that it stimulates a global approach. The customer can benefit from having access to a broader product range.

Bearing this in mind, we know that we will be on a steep growth curve with numerous challenges.

Was this service page helpful ?

UBO Register AML

Compliance Risk Assessment

Risk Based Approach

Regulatory Watch

Monitoring and Reporting

BMR Benchmark Regulation

Incident Reporting

Ethics and Standards

Policies and Procedures

Adverse Media

Compliance Action Plan

Learning Management

Corporate Governance

Anti Money Laundering

MiFID MiFIR

Insider Dealing

Common Reporting Standard

FATCA

Know Your Customer

Politically Exposed Persons

Customer Due Diligence

Sanctions and Embargoes

Market Abuse

Anti Bribery and Corruption

Cryptocurrencies

Cybersecurity

Screening

Terrorist Financing

Anti Fraud

Payment Service Directive 2

MiFID: Time for information transparency

MiFID (Markets in Financial Instruments Directive) was put into force in November 2007 and was created with the objective of harmonising Europe's financial landscape. This Directive changed how the financial markets worked and especially how they were ruled. MiFI...

Read more Author What else ?