Compliance Consulting

Risicobeheer- en adviesbureau

Neem contact op

info@pideeco.be

Compliance Consulting

Risicobeheer- en adviesbureau

De opkomst van Digital Business Compliance Approach

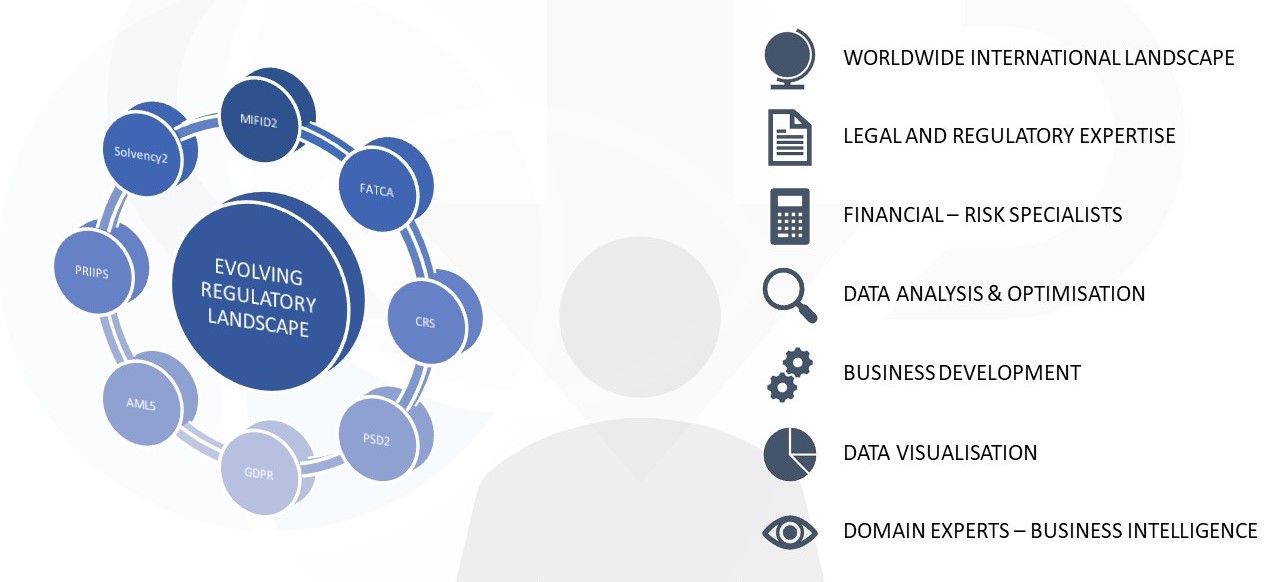

The content of Compliance changed in the past years as an answer to the changing financial and socio-economic environment.Within Compliance we can distinguish two major blocks. The first block is everything related to Financial Crimes Compliance and the second block is the Central Compliance.

The organisation of all the compliance monitoring and controlling activities

Learn moreFinancial regulatory compliance modern challenges

The changing regulation, reporting (not solely FATCA and CRS), financial crisis (MiFID2, PRIIPs,...), shareholder return, source of wealth and source of funds (vast majority of UHNWI will no longer be based on continental Europe but in other parts of the world like the United States, China, Brazil, Russia, India, Australia,...) require a different approach within the financial business environment.

The capabilities of a consultant in Compliance requires a multiskilled person that can cope with numerous publications. The high degree of harmonisation across the EU through the single rulebook after the financial crisis allows us to partner with our colleague consultants around Europe.

Legal harmonisation stimulates the compliance global approach

Within the Insurance world we are also able to speak with peers in the market as the harmonization through Solvency II applies.The deployment or the positive equivalence determination of Solvency II in Bermuda had already an impact in Belgium and continental Europe.

So on the one hand we might think that overregulation would slow down the business, but on the other hand we observe that it stimulates a global approach. The customer can benefit from having access to a broader product range.

Keeping that in mind we know that we will be on a steep growth curve with numerous challenges.

Was deze servicepagina nuttig?

Financiering van terroristen

Richtlijn betalingsdiensten PSD2

Handelen met voorkennis

MiFID en MiFIR

Cyber security

Marktmisbruik

Know Your Customer KYC

Klantonderzoek

Sancties en embargos

Anti Fraude

FATCA wet

Witwassen van geld

Virtueel geld

Screening Tools

Omkoping en corruptie

Common Reporting Standard CRS

Politiek prominente personen

Nadelige media

Risicogebaseerde aanpak

Monitoring en rapportage

Ethiek en normen

AML UBO Register

Ondernemingsbestuur

Beleid en procedures

Nalevingsactieplan

Incidentrapportage

Benchmark BMR

Nalevingsrisicobeoordeling CRA

Wettelijk toezicht

Interne opleiding

Compliance voor verzekerings en herverzekeringsbedrijven

Verzekerings-/herverzekeringsmaatschappijen spelen een belangrijke rol voor de Europese economie. Veel Europese landen, waaronder België, staan in de top 20 van OESO-landen met de hoogste brutoverzekeringspremies, met een Belgische premie van ongeveer 30 miljard dolla...

Read more Author What else ?