In March 2019, the names of three leading Belgian banks (ING Belgium, KBC, and BNP Paribas Fortis) were involved in allegations for laundering dirty Russian money. OCCRP, operated by the Journalism Development Network, has revealed information on this and many other scandals. The International Monetary Fund (IMF) has estimated the amount of money laundered globally per year to be 2 to 5% of global GDP, or nearly 2 trillion US dollars.

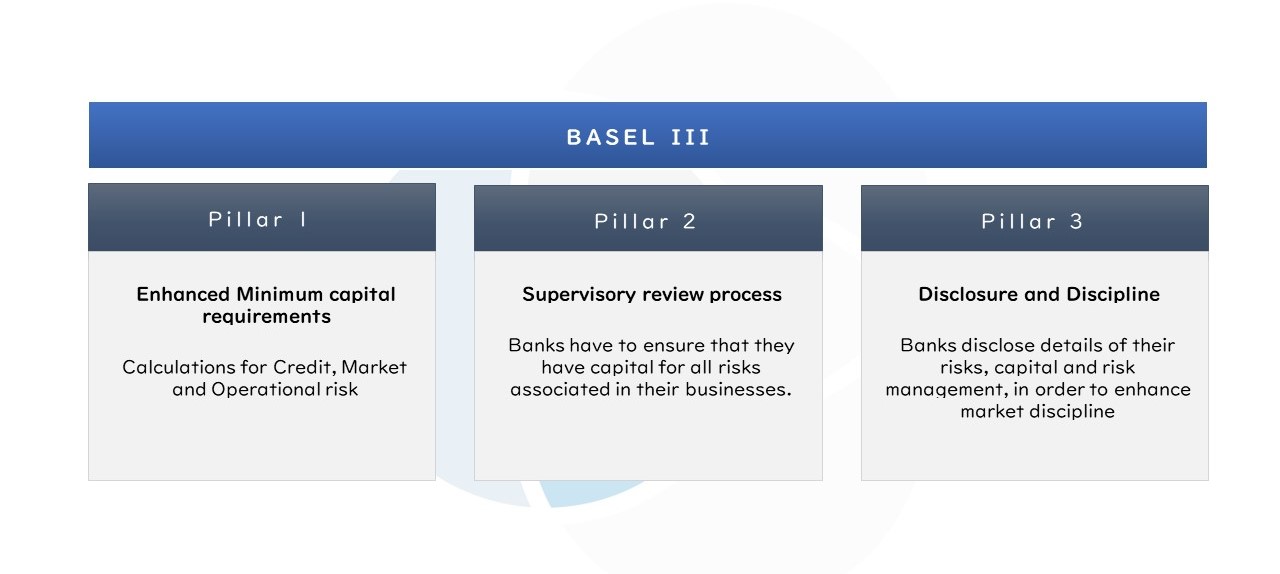

💶 What are the Basel standards framework for banks and financial institutions?

In Belgium, the law of 25 April 2014 is the basis for the compliance obligations of banks, credit, financial institutions, etc. The law of 25 April 2014 has been revised by the law of 26 November 2021 to implement the EU Directive 2019/2162. As for insurance companies, in Banking the independence of the control functions is very important. Banking institutions shall have an independent compliance function to ensure compliance of the bank and the members of its senior management, its employees, its representatives and tied agents with the applicable regulatory framework on integrity and conduct.

💰 What are Compliance Regulatory Requirements in the Banking industry?

- Continuously changing regulations in international and European level. The compliance function becomes more demanding. Smaller banks with weak compliance departments until now, need to enhance the number of their professionals, IT tools and their working proficiency.

- Risk management. Basel III increases pressure on the proper detection, measuring and reporting of risks. Emerging risks are a constant threat. Risk functions in banks have to change how they work, enable innovation and become more cost-efficient.

- Money laundering. Scandals have surfaced lately and large amounts of money were laundered through European banks. Even if they are not aware of laundering money, banks remain liable.

- Reporting: proper reporting is a demanding process for banks which function in different jurisdictions. Each jurisdiction has different reporting standards, which makes the reporting projects more complicated.

- GDPR requirements. As banks are handling large quantities of personal information, data storage and management remains a significant compliance project. Some banks are trying to take advantage of GDPR by promoting their compliance with the regulation and in this way, enhancing trust and customer engagement.

In 2016, the European Central Bank (ECB) revoked Trasta Komercbanka’s license because the bank violated in different ways the provisions for money laundering and terrorist financing. The bank was involved in the so-called “Russian Laundromat”, an international money laundering scheme. In the same scandal, Deutsche Bank was also involved. The OCCRP has recently published that the bank's internal investigation revealed that it might face penalties for non-compliance with AML laws and its senior management could risk prosecution. The paper states that the bank was unaware that it was moving billions sourced from illicit activities.

Compliance has become a core business for banks. Banks should adopt a top-down approach in compliance. High management should be the role model for the staff and functions of the entity. Training and open dialogue between c-level professionals and other staff, have to take place often to reassure the smooth integration of changes in the compliance framework.