🎬 Introduction to RegTech and Regulatory Compliance

It might require to adapt or to remodel system interfaces, rationalise business processes and workflows, to create or to update policies and procedures that formalise the new compliance methodology and its working instructions.

Today's cost of non-compliance could increase the amount of compliance revision if the means put in place are considered insufficient and have been proven to be the source of poor vigilance or lack of controls leading to an abuse of the financial system.

Cost-effectively speaking, it is during that crucial moment that Reg Tech startups and Reg Tech companies entered the financial services market.

⚙️ What is RegTech or Regulatory Technology ?

Being aware of the difficulties that financial institutions are constantly faced when remodelling their operational systems and processes to keep up to pace with the trends in the regulatory landscape expansion, Reg Tech startups took the opportunity to offer compliance tools that help financial organisations process legal requirements more efficiently, cost-productively and with more agility.

Nowadays the Reg Tech industry is growing rapidly and Reg Tech companies are entering the most significant and newest financial operators that deliver innovative cloud computing technology solutions to help them analyse and treat their data in a more complex and automated way. Artificial Intelligence through Machine Learning algorithms is setting new standards in patterns recognition and is already being used for detecting and preventing financial crimes.

🤔 What is the difference between FinTech and RegTech ?

Finance and Information Technology symbiosis was established a long time ago. Fin Tech is a new industry that applies innovative technology to serve and improve financial activities.

Sensitive regulatory requirements do not solely regard banking and financial industries. Governmental applications, pharmaceutical industries, and human resource services could be the next generation of businesses to benefit from Reg Tech compliance platforms and dedicated services aimed at reducing the cost of regulatory compliance.

Bio-metric technology is it Fin Tech or Reg Tech ?

The line is thin between Fin Tech and Reg Tech. The certainty is that the first industry brought the second to life and both can be perfectly combined. Reg Tech companies are already shaping the future standards of banking and financial institutions' analysis, monitoring and reporting aspects of regulatory compliance, but Reg Tech is by definition applicable to various industries.

🏭 Reg Tech Solutions for Compliance Officers in the finance industry

RegTech KYC and RegTech AML

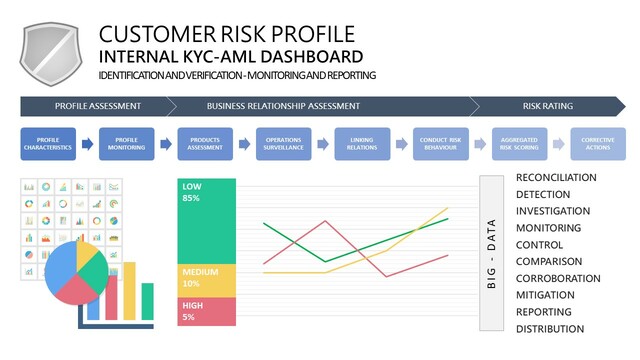

The know your customer regulation or KYC is a major concern among the compliance processing domains.To realise the applicability of swiftly changing regulations to ensure that appropriate controls are in place is not an easy task.

All along the course of the business relationship, the financial firms need to identify and verify the identity of their customers.

To prevent financial institutions from being used for criminal activity such as money laundering, continuous monitoring of transactions and other customer behaviours, assessments of the relationship and individual risk profiles are a complex but a necessary burden.

The complexity of the identification and verification processes and continuous evolving aspects of these variables often leads to assigning these essential parts of the process of detection of financial crimes to manual pricey and labour consuming investigation processes.

This ultimately exposes financial accountability in the fight against money laundering and prevention of the abuse of the financial system.

The monitoring of transactional behaviour is one of the most essential elements in helping compliance officers to detect anomalies. The technology behind financial companies payment or exchange services is designed to capture the details of every transaction occurred in their network.

Modern-day technology-driven mechanisms reinforce the knowledge and control of criminal activity patterns hidden behind the gigantic amount of data transactions carried out by the detection systems of financial institutions.

Artificial intelligence already fed by detection scenarios and enhanced with pattern recognition (machine learning) mechanisms, challenges compliance officers in the discovery of suspicious transactional behaviours.

Reg Tech KYC and Reg Tech AML solutions are leveraging technology to foster the inclusion of big-data pertinent information analysis, monitoring and reporting into banks and financial institutions preventive due diligence operations to fight against the misuse of the financial system and to help detect suspicious financial crime situations such as money laundering, tax avoidance, terrorism and nuclear weapons financing.

Thanks

The way you explain about regulatory and finTech and RegTech is very clear. Very good explained and knowledge able and clealy concept about this regulatory i would like to thank you

Thank you so much for your support Johnny, We will try to continue to publish good informative articles throughout the next year. Stay tuned!

Interesting. This looks super cool. I haven't read it all yet, but I'll be back to read the rest of it.

Dear Roger, We hope that you have been able to enjoy the article in its entirety since your comment, for which we thank you warmly.